- #SAKS OFF FIFTH PAPERLESS EMPLOYEE PAY STUB HOW TO#

- #SAKS OFF FIFTH PAPERLESS EMPLOYEE PAY STUB SOFTWARE#

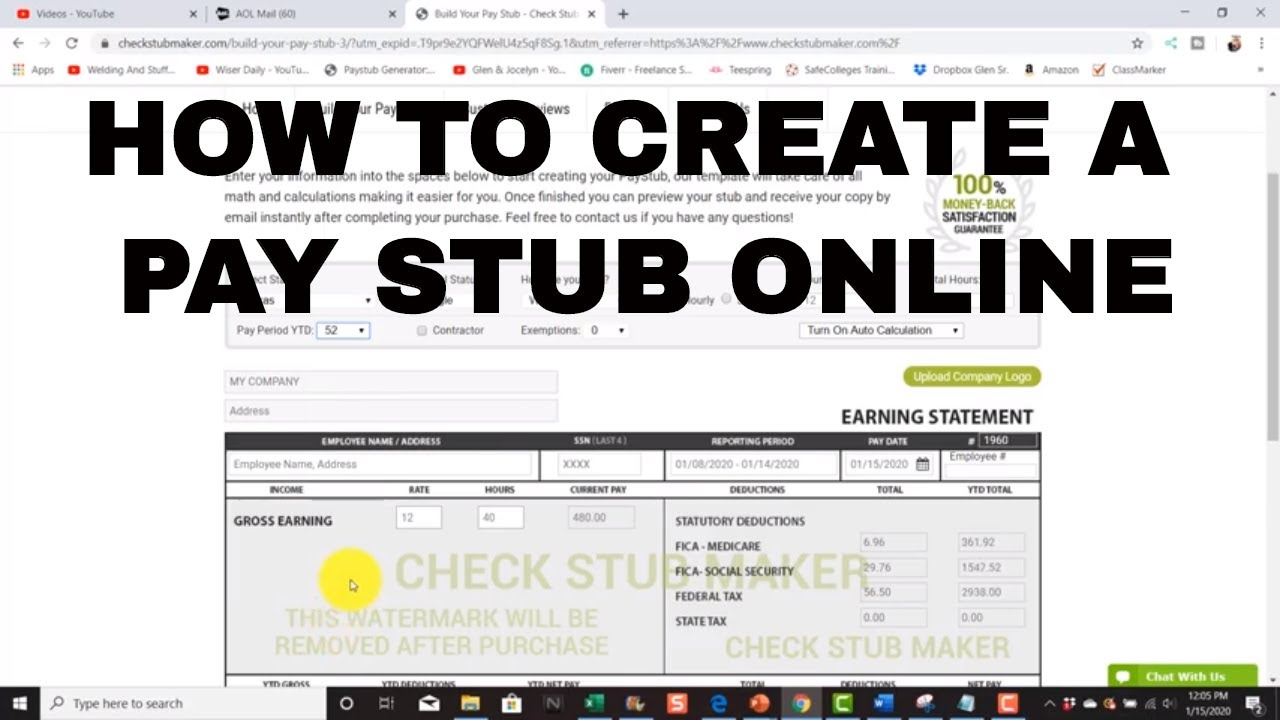

They start with an employee’s total gross pay for the pay period. Pay stubs break down an employee’s income for a given pay period. While employers are not required by federal law to provide employees with pay stubs, they’re an essential part of payroll accounting and are considered a best practice in payroll accounting. Now, pay stubs are usually offered digitally and – for employers that use a paperless payroll or a payroll service – are available online to download when needed. Historically, pay stubs were attached to employees’ physical paychecks, which is how they got their name. It’s also a record of how much was withheld from each employee’s paycheck and for what purpose. Ī pay stub serves as a payment receipt for the employer. Pay stubs also list itemized withholdings for taxes, such as Medicare and Social Security (FICA), and deductions for items like health insurance premiums and employer-sponsored retirement plans. Stubs show an employee’s gross income during a specific pay period, including wages, commissions, bonuses and tips. What is a pay stub?Ī pay stub is a financial record that shows an employee’s paycheck breakdown.

#SAKS OFF FIFTH PAPERLESS EMPLOYEE PAY STUB SOFTWARE#

Creating pay stubs manually can be tedious, but any good payroll software or service makes it easy. Pay stubs serve as a receipt of payment of wages and withheld taxes they also provide employees with a breakdown of their pay, including deductions. If you have employees, it’s crucial to generate pay stubs for each pay period.

#SAKS OFF FIFTH PAPERLESS EMPLOYEE PAY STUB HOW TO#

This article is for business owners who want to better understand pay stubs and how to create them.While you can manually create a pay stub, payroll services make the task substantially easier.A pay stub includes gross wages, commissions and bonuses, taxes, and health insurance premiums.A pay stub is a financial record that shows the breakdown of an employee’s paycheck.

0 kommentar(er)

0 kommentar(er)